New "Innovation Platform" Launched for the Digital Euro, with 70 Private Sector Partners

As part of the European Central Bank’s (ECB) sprint to reach October 2025 deadline of the Digital Euro launch stage, it announced today an innovation platform to explore the digital euro, collaborating with around 70 banks, fintechs, and merchants.

Here’s the complete list of 70 “innovation partners”, consisting of two groups of participants:

Pioneers – testing conditional payments (e.g., funds released on delivery).

Visionaries – proposing use cases like offering digital euro access through post offices for underserved populations.

The ECB will provide technical tools (APIs, SDKs) to help participants integrate and experiment. A full report on findings is expected by the end of 2025.

Even though Europeans are clearly not interested in a digital euro—as reflected in a recent ECB survey showing most prefer existing payment methods—the ECB is pressing ahead regardless, ignoring this lack of demand. I covered this survey on my X:

And on my latest article on ZeroHedge and Bitcoin Magazine:

Revolut CBDC Survey for the ECB

I guess the ECB didn’t like the results of the 19K Europeans survey - who are NOT interested in CBDC, because they’re now using commercial banks to carry on more surveys, enter Revolut; Revolut Bank customers were emailed a survey on May 2nd 2025, conducted FOR the ECB, about “Digital Cash”, let’s explore what it means (see my X thread):

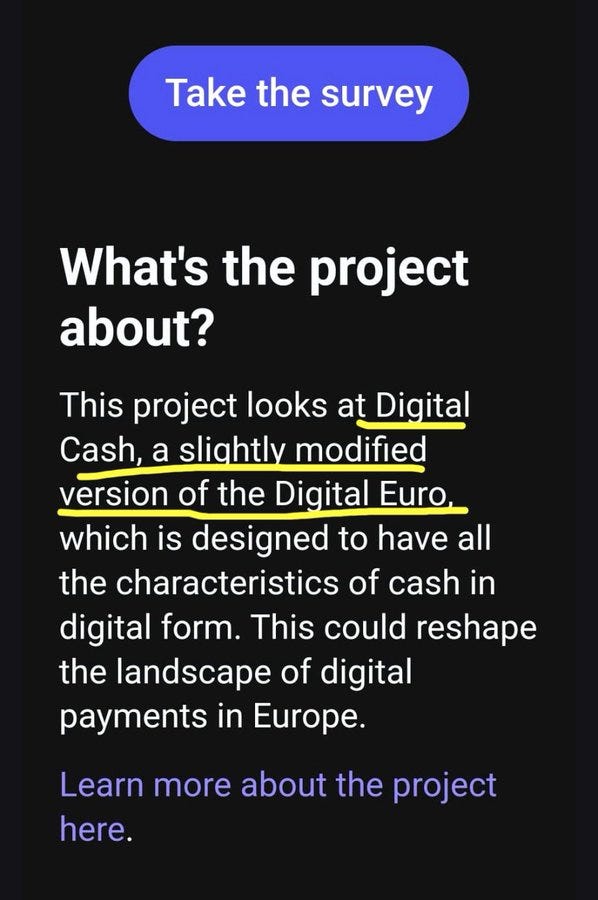

The digital cash is presented as “a slightly modified version of the digital euro”. From the email:

“What's Digital Cash?

Digital Cash is designed to complement existing cash and digital payment systems — think of it as cash, only digital. It would be used across the eurozone, with all merchants legally obliged to accept Digital Cash payments. It would be managed by the European Central Bank (ECB).”

“How would it work?

Access to Digital Cash would be facilitated by a dedicated application that would allow people to manage their funds, conduct transactions, and securely store their digital assets This app would provide an experience similar to existing digital wallets to both individuals and businesses (much like online banking applications) People would be able to send transfers, make online and in-store payments, and seamlessly monitor their account balances The system is expected to support both online and offline transactions, so it can be used without an internet connection The ECB would be responsible for the issuance of Digital Cash and for the development and maintenance of the Euro Wallet — an open-source digital wallet with basic payment functionalities available free of charge Supervised payment service providers (PSPs), like banks, would be able to develop alternative wallets with more advanced features, such as fraud detection and dispute resolution mechanisms”

“How would it differ from traditional currencies and banking practices?

Unlike traditional banking systems, opening a Euro Wallet account wouldn't require identity checks, increasing its accessibility Individual balances of Digital Cash wouldn't be subject to pre-defined limits, distinguishing it from other digital payment instruments Would it be safe? Transactions conducted via the Euro Wallet are expected to maintain a high level of privacy, with only the sender and receiver having access to transaction details, similar to cash Anything else I should know? The basic services associated with Digital Cash, including those provided by the Euro Wallet, are expected to be free of charge for both individuals and merchants Merchants opting for enhanced services offered by PSPs would be charged, although Digital Cash is expected to offer lower payment processing costs compared to existing digital payment solutions (e.g. credit card circuits) If you'd like to participate in creating the future of digital finance, tap Take the survey below. We’re excited to hear what you think.

Take the survey — Team Revolut”

A “learn more” link was shared with Revolut’s customers, as well as this short video:

Click here for the complete list of questions they asked in the survey.

And here I thought CASH is supposed to be physical, and private.

Europeans, I hope you’re taking actions to hedge your hard-earned savings!

Please take a moment to like and share this article.

♥️ Efrat

► Want to be more active about CBDCs? join my community on Twitter/X.

► Relevant CBDC related articles:

Follow me:

Twitter | Telegram | YouTube | Instagram | My podcast | All other links

►New: Watch “New Totalitarian Order”

With Prof. Mattias Desmet - Full 3 hours conference + bonus content!

Sponsors:

►► Get your TREZOR wallet & accessories, with a 5% discount, using my code at checkout (get my discount code from the latest episode - yep, you’ll have to watch it)

Join me on these upcoming events:

May 2025 - Bitcoin Vegas - code EFRAT for 10% off

June 2025 - BTC Prague - code EFRAT for 10% off

Special offers:

►► Watch “New Totalitarian Order” conference with Prof. Mattias Desmet & Efrat!

►► Enjoy the Little HODLer products - code EFRAT for 10% off

►► 10% off on all books & accessories at the “Bitcoin Infinity Store” - use code EFRAT

— Support my work —

The best way to support me is by becoming a paying subscriber.

You can also “buy me a coffee” for a 1-time support, or with Bitcoin here.

Thank you!