Is Our Money Safe? On Financial Censorship, Bank Accounts Closures & Confiscations

Vigilance about financial censorship and asset protection can mean the difference between sound money and confiscated money.

In recent years we have witnessed an alarming trend of closing bank accounts or freezing assets based on political affiliation, ideologies, participation in demonstrations or international sanctions.

For example, in 2019, major banks such as HSBC and Standard Chartered closed accounts belonging to people associated with pro-democracy protests in Hong Kong, citing concerns about compliance with China-imposed national security laws. Similarly, in 2020, several banks in Belarus shut down accounts of people involved in anti-government protests following a disputed election, arguing that their activities posed a risk to the stability of the financial system. Moreover, international sanctions have led to the closing of accounts and freezing of assets of individuals and entities in countries such as Iran, Venezuela and North Korea, based on their government's policies or actions deemed to be contrary to international norms. These actions highlight the challenges individuals face in maintaining access to financial services amid political turmoil and global geopolitical tensions, and raise significant concerns about financial censorship and the need for greater protection of individuals' rights to access their finances. Regardless of whether we agree or disagree with the ideology or perspectives of the oppressed, the use of state power and banking mechanisms to suppress dissent or enforce political agendas underscores the inherently unfair nature of the fiat-based financial and governance systems.

Regardless of whether we agree or disagree with the ideology or perspectives of the oppressed, the use of state power and banking mechanisms to suppress dissent or enforce political agendas underscores the inherently unfair nature of the fiat-based financial and governance systems.

Let's look at several examples of this trend:

The German government has announced a plan to target bank accounts of people who donate money to groups and entities considered "extreme right" - which is actually the common name these days for people who oppose the government or are called "conspiracy theorists".

In Israel, no matter which side of the political spectrum you are on or what your position is regarding the war, you probably won't like to learn that the US president has the power to order your bank to confiscate your bank account as a political sanction, even before you have stood trial in Israel and been proven guilty of a crime. Yes, even if you are so called "settlers". This is what happened last month to two Israeli citizens that Biden imposed direct sanctions on, and Bank Leumi complied and froze their bank accounts. Also in Israel, in December 2023, the financial paper Calcalist reported that the Vice President of the District Court in Tel Aviv, Eliyahu Bachar, ordered Bank Leumi to unblock the account of the NGO called "Gisha", which legally assists Gaza residents in obtaining entry permits to Israel, in light of its publications on social media, in which the NGO accused Israel of war crimes. "Publications, as shocking and difficult as they may be to the bank's ears, are not enough to block an active bank account," said judge Bachar.

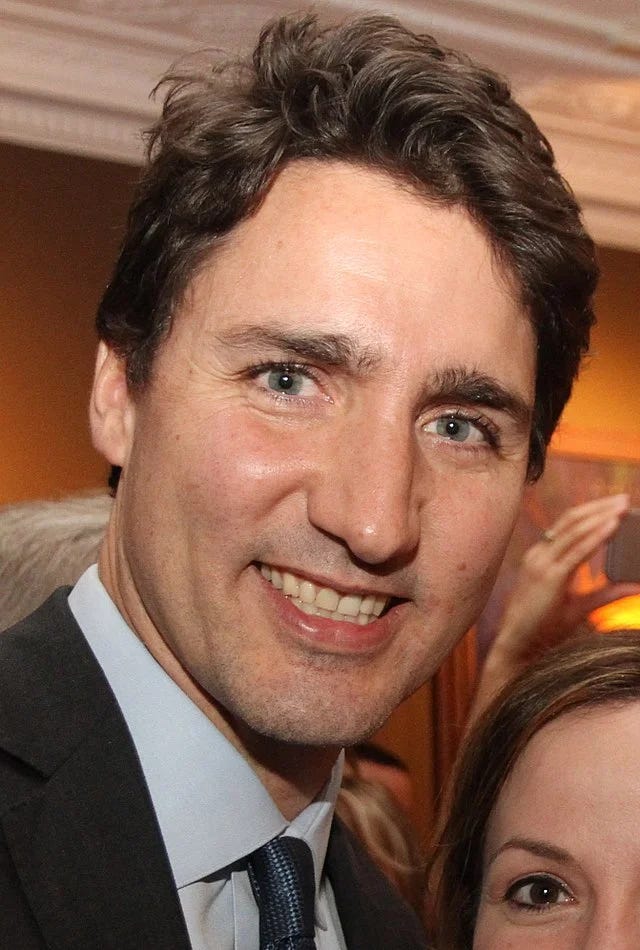

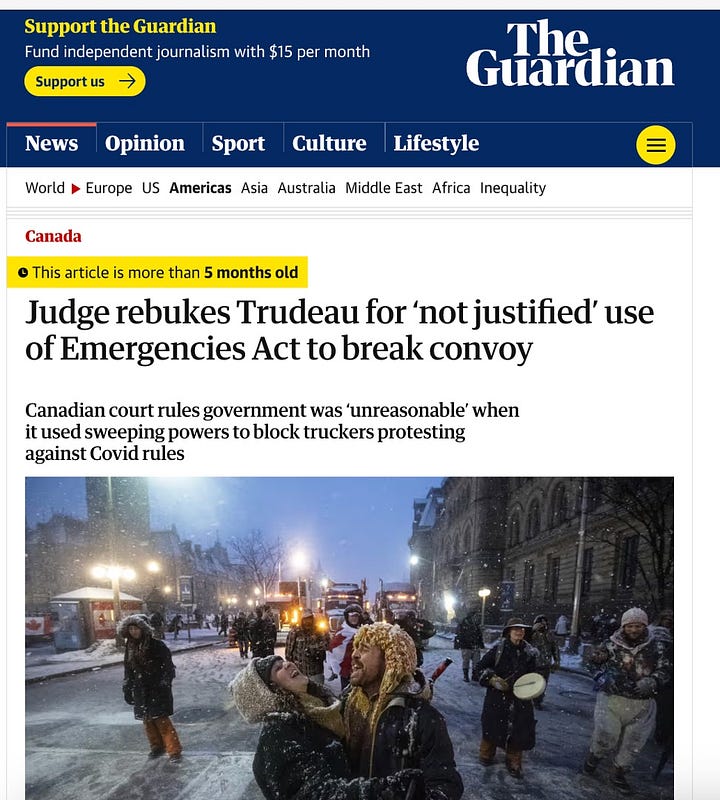

About two years ago, we saw Canadian Prime Minister Trudeau closing bank accounts and confiscating donations in dollars and in crypto-currencies, to Canadian citizens who participated in the truckers protests in Canada, under an emergency act he issued, for the first time in history. Recently, in January 2024, a Canadian court ruled that the Trudeau government's activation of the state of emergency was unjustified, and did not justify the use of sweeping powers to suppress what the Prime Minister called "illegal and dangerous" protest barriers across Canada two years ago. But this is just a small reminder that if the administration wants to suppress opposition in real time, it can. The only money, by the way, that finally reached the Canadian protesters was Bitcoin, since the establishment has no way to block and take control of it.

In June 2023, we witnessed the bank account scandal of Nigel Farage - the British broadcaster and former politician - when the private bank Coutts closed his account, on the basis of his opinions and positions. After Farage reached out to the press about the closure, it was revealed that his account had been closed because they considered him "at best a xenophobe, leaning to racism". Following the media exposure, the CEO of the bank that owns Coutts Bank resigned. Farage, by the way, approached seven other banks which refused to open an account for him.

And in Australia, as of November 2023, NAB Bank has announced the freezing of bank accounts of Australians who express themselves online in a way that the bank defines as hate speech, in an inappropriate, harassing or discriminatory manner.

Another important reminder is Cyprus, where just over a decade ago, during the great banking collapse of 2012-2013, citizens' money was confiscated: Cyprus implemented a controversial measure known as a "bail-in", as part of a deal with international lenders, imposing a one-time tax on bank deposits: for deposits below €100,000, the tax rate was set at 6.75%, while deposits above €100,000 were initially proposed at a tax rate of 47.5% but finally set at 9.9% after a public outcry. This effectively led to the seizure of a portion of people's bank accounts. This move caused widespread public outcry and significant economic repercussions, but it was seen as necessary to stabilize the country's banking sector and secure financial assistance.

It seems that the authorities do not hesitate to use this method increasingly over time, and therefore the question arises: is our money safe in the banks, or should we start investigating “safer” money, such as precious metals, or money that the establishment cannot obtain, such as Bitcoin. In his best-selling book "The Bitcoin Standard" Saifedean Ammous addressed the issue of confiscation of funds by banks and the disproportionate power that the state achieved through centralized control of money: "Bitcoin goes a long way in correcting the imbalance of power that emerged over the last century when the government was able to appropriate money into its central banks and thus make individuals utterly reliant on it for their survival and well-being.

The historical version of sound money, gold, did not have these advantages. Gold’s physicality made it vulnerable to government control. That gold could not be moved around easily meant that payments using it had to be centralized in banks and central banks, making confiscation easy. With Bitcoin, on the other hand, verifying transactions is trivial and virtually costless, as anyone can access the transactions ledger from any Internet-connected device for free”.

Gold has been perceived as sound money for the past 5000 years, and has historically served humanity as a successful store of value as well as a medium of exchange and a unit of account. The shortcoming of gold lies in its physical properties that allowed its institutional takeover and concentration in the hands of the state, which became the main intermediary between people and businesses that wanted to engage in trade. Unlike most other cryptocurrencies, Bitcoin is a digital currency without intermediaries and third parties (peer-to-peer) in a decentralized, secure network, which enables everyone to be their own bank, instead of relying on banks and external parties.

Either way, it's worth paying attention to the challenges citizens face in maintaining access to financial services amid political turmoil and global geopolitical tensions. Vigilance about financial censorship and asset protection can mean the difference between sound money and confiscated money.

— End

This article was published on "Passphrase Magazine", published by Mallorca Blockchain Days Conference, and it also exists in Hebrew here.

Sponsors & Affiliates:

►► Get your TREZOR wallet & accessories, with a 5% discount, using my code at checkout (get my discount code from the latest episode - yep, you’ll have to watch it)

Trezor - Bitcoin Hardware Wallet

In this section you’ll find the companies / initiatives I trust and recommend. I never recommend a brand I haven’t worked with, used their products or took part in their activities, so you can be sure you’re presented with companies I trust. Trezor Regardless of how you buy your bitcoin, you should always move your coins to your self-custody, in your own…

►► Join me at Bitcoin Nashville with 10% off tickets (use code BTCIL)

►► Join me at Mallorca Blockchain Days with 50 euro off tickets (use code efrat)

Please follow me:

Twitter | Telegram | YouTube | Instagram | My podcast | All other links

— Support my work —

The best way to support me is by becoming a paying subscriber.

You can also “buy me a coffee” for a 1-time support, or with Bitcoin here.

Thank you!